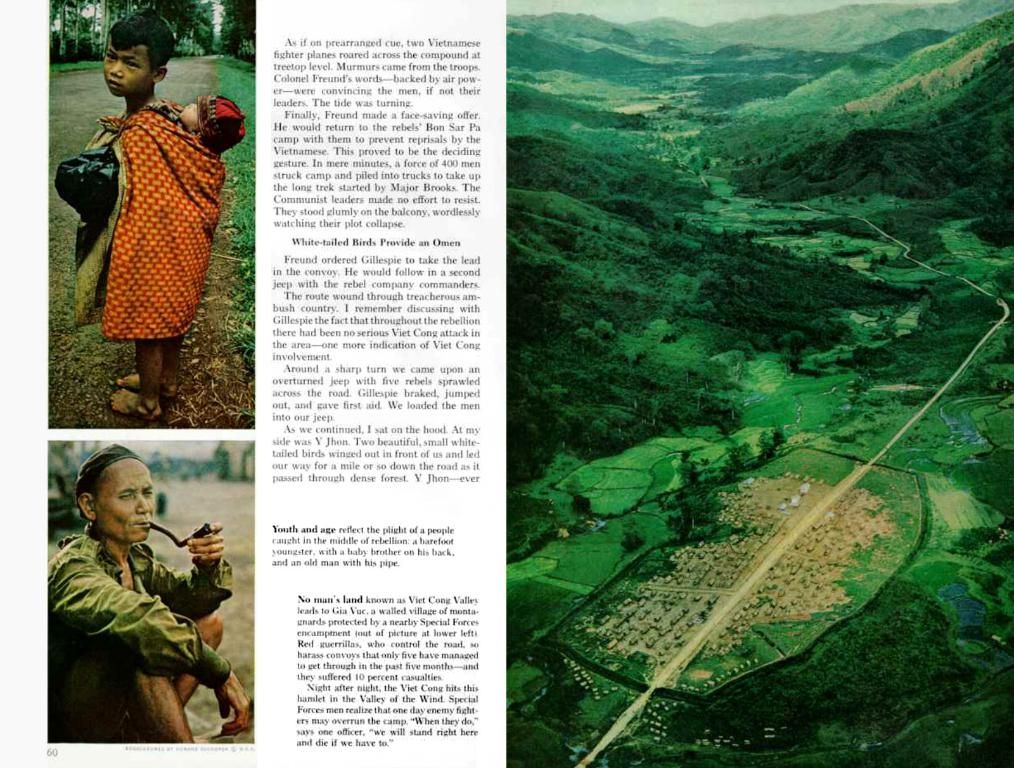

A Shift in Investment Preferences: Institutional Interest in Bitcoin Soars

Wall Street's Newfound Obsession: The Rise of Bitcoin as a Valuable Asset

In the United States, BlackRock's spot Bitcoin ETF, iShares Bitcoin Trust (IBIT), has been the hottest investment vehicle, overshadowing traditional ones like the SPDR Gold Trust (GLD). Since the start of the year, IBIT has seen an astounding inflow of $6.96 billion, exceeding GLD's $6.51 billion.

Gold had an impressive 2021, reaching a record high of 23.07%, but IBIT, despite gaining only 4.03%, has become a sought-after choice among institutional investors. As per Bloomberg analyst Eric Balchunas, IBIT ranks sixth among U.S. ETFs with the most inflows this year, hinting at Bitcoin shedding its speculative image and finding a lasting spot in portfolios.

Zaheer from Split Capital encapsulated the situation with his statement, "Wall Street can't get enough of Bitcoin."

Driving Forces Behind Institutional Investment

The Appeal of Bitcoin as a Store of Value

Institutional investors are drawn to Bitcoin due to its perceived value as a store of wealth and a hedge against currency devaluation and economic instability. Attributes such as scarcity, immutability, and non-sovereign portability make it an attractive option for portfolio diversification in uncertain times [1][3].

Institutional Engagement with Digital Assets

The rise in institutional interest is fueled by the growth of strategy teams dedicated to digital assets, blockchain analyst hiring, and long-term investment. Improved infrastructure and services tailored to institutional needs further bolster this trend [3][5].

Regulatory Clarity and Market Maturation

As regulatory clarity improves, institutions are more inclined to invest in Bitcoin. This clarity, combined with the maturation of the cryptocurrency market, enhances Bitcoin's legitimacy and acceptance as a genuine asset class [5].

Regulatory Developments Supporting Investment

While specific regulatory information was unavailable, the overall trend indicates that increased regulatory clarity is a crucial factor driving institutional investment in Bitcoin. This clarity helps reduce uncertainty and fosters investor confidence:

- Regulatory Acknowledgement: As governments and regulatory bodies provide clear guidelines and frameworks for cryptocurrencies, institutional investors feel more secure in investing in Bitcoin. This recognition also supports the development of more advanced financial products associated with Bitcoin [5].

- Bitcoin ETFs: The increase in Bitcoin ETFs provides structured and regulated avenues for larger investors, further encouraging institutional investment [3].

- Government Involvement: Government involvement, such as the creation of a Bitcoin reserve in the U.S., reinforces the legitimacy and visibility of Bitcoin as a viable investment option [3].

Bitcoin's Continuing Rise

Over the last 24 hours, Bitcoin has experienced a 3% increase in value, currently trading at around $97,026. Weekly growth amounts to 2.2%, monthly growth to 29%, and yearly growth to 52%. Despite its remarkable surge, Bitcoin's potential for continued growth remains encouraging.

Unlock a $600 Bonus from Binance (Exclusive Offer): Follow this link and claim your exclusive $600 bonus from BinanceDetails

Latest Bitcoin (BTC) Updates

Follow us on Facebook | Twitter | LinkedIn | Telegram

Crypt technology plays a significant role in facilitating the rise of Bitcoin, with blockchain analyst hiring and the growth of strategy teams dedicated to digital assets contributing to institutional engagement with Bitcoin and digital assets.

The increasing acceptance and legitimacy of Bitcoin as an asset class, in part due to regulatory clarity and the creation of Bitcoin ETFs, make investing in Bitcoin an attractive option for institutional finance and investing.