Trump Advocates for Dominance in Cryptocurrency Sphere to Challenge China's Influence

In a significant shift in U.S. policy, the recent executive order supports the development of decentralized cryptocurrencies, marking a departure from the previous exploration of a Central Bank Digital Currency (CBDC). This approach contrasts starkly with China’s digital yuan, a state-issued CBDC that leverages blockchain technology for broad state control.

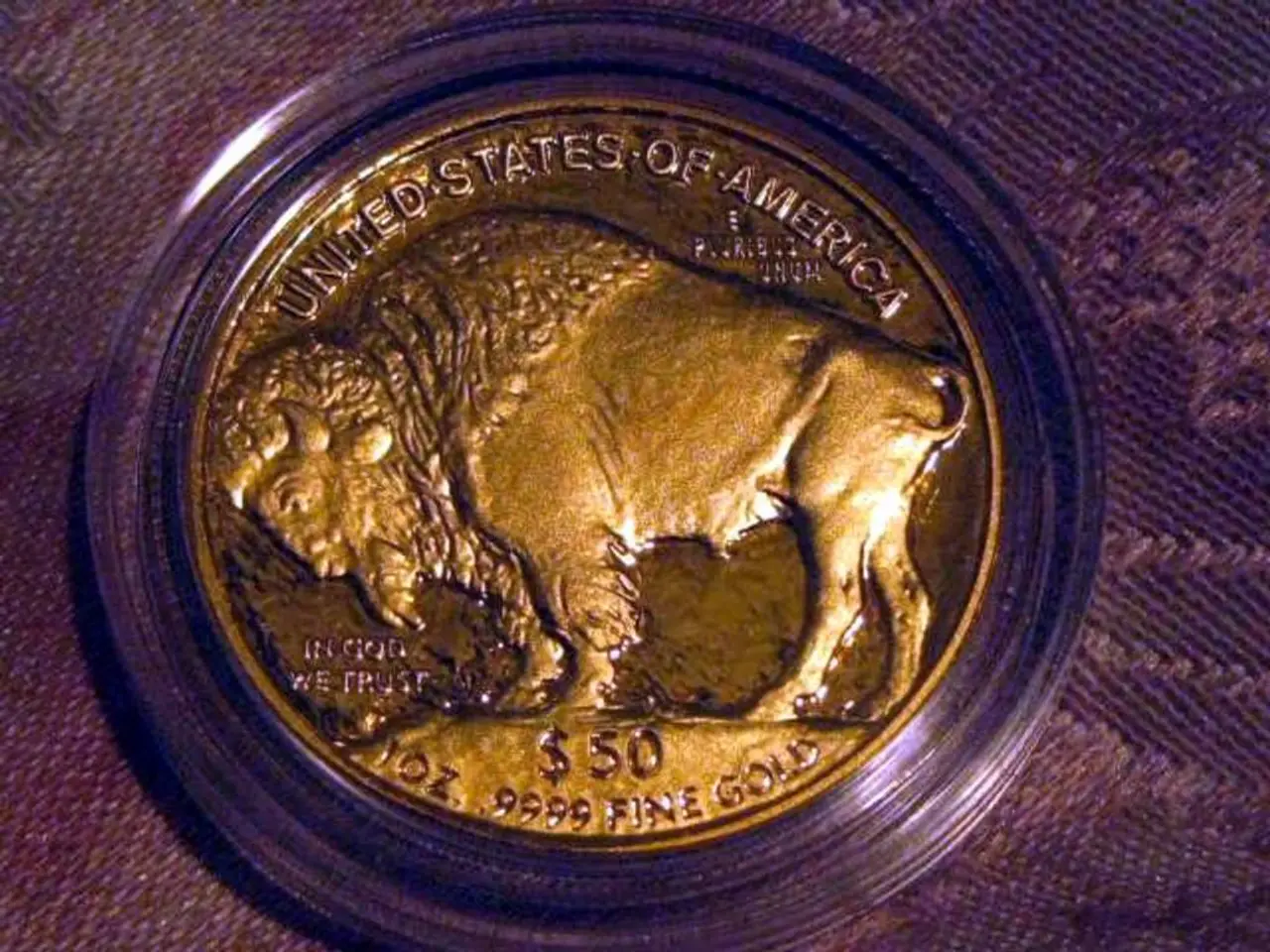

The year 2025 saw key developments in the U.S. crypto landscape. In January, the Biden/Trump administration revoked the previous executive order and Treasury framework exploring a U.S. CBDC, explicitly prohibiting the creation of a U.S. CBDC [1]. Instead, the President’s Working Group on Digital Assets Markets was formed to develop a federal regulatory framework and a national digital asset stockpile. This stockpile, comprising forfeited Bitcoin held by the Treasury, serves as a strategic crypto reserve, reinforcing a government-held crypto reserve strategy rather than a CBDC issuance [1].

The introduction and signing of the GENIUS Act in July 2025 marked the first U.S. federal legislation specifically targeting stablecoins. The act aims to provide clarity and consumer protections, fostering integration of digital assets into the regulated financial system while avoiding direct issuance of digital currency by the government [2][4]. Ongoing legislative efforts such as the CLARITY Act and the Responsible Financial Innovation Act (RFIA) aim to delineate jurisdiction between the CFTC and SEC and clarify rules distinguishing securities from digital commodities [2].

Regulatory agencies like the SEC have shown a cautiously open stance toward crypto exchange-traded products (ETPs), signaling heightened scrutiny on investor protections, custody, asset valuation, and operational risk for crypto funds [5].

China’s digital yuan (e-CNY), on the other hand, is a CBDC issued and tightly controlled by the People's Bank of China. Leveraging blockchain technology primarily for domestic monetary control, anti-money laundering, and state surveillance, China pursues widespread rollout of its digital yuan as a CBDC accessible to consumers and businesses. The aim is to reshape the monetary system and retail payments with blockchain infrastructure as a backbone.

The U.S. approach to cryptocurrency is based on the principle of privately-led innovation, promoting a regulated crypto ecosystem integrating with traditional finance without issuing a CBDC. This contrasts with China’s state-issued digital currency leveraging blockchain for monetary reform and control.

| Aspect | U.S. Crypto Policy (2025) | China’s Digital Yuan and Blockchain | |-------------------------------|-----------------------------------------------------|-----------------------------------------------------| | Central Bank Digital Currency | Prohibited; no U.S. CBDC planned | Fully developed & deployed as state-backed CBDC | | Regulatory Approach | Federal legislation focusing on stablecoins, clear regulatory framework, market structure reforms | Government-controlled issuance, blockchain-backed transactions | | Government Crypto Reserves | Strategic Bitcoin Reserve and Digital Asset Stockpile composed of forfeited assets | Not applicable; direct issuance of digital yuan | | Integration with Financial System | Encouraged, with regulatory clarity and hybrid agency jurisdiction (SEC, CFTC) | State-controlled integration with payment systems | | Innovation Focus | Encouraging market innovation while ensuring investor protections and federal oversight | Control and modernization of currency via blockchain |

This shift in U.S. policy reflects a desire to promote a regulated crypto ecosystem integrating with traditional finance without issuing a CBDC, contrasting with China’s state-issued digital currency leveraging blockchain for monetary reform and control.

[1] Revocation of CBDC exploration and creation of Strategic Bitcoin Reserve: https://www.treasury.gov/press-center/press-releases/Pages/r22084.aspx [2] Introduction and signing of the GENIUS Act: https://www.congress.gov/bill/117th-congress/house-bill/4617 [3] Ongoing legislative efforts: https://www.cftc.gov/pressroom/press-releases/8119-19 [4] Regulatory agencies' stance on crypto ETPs: https://www.sec.gov/news/press-releases/2025-XX-XX [5] China’s digital yuan development and testing: https://www.reuters.com/article/us-china-digital-currency/china-widens-testing-of-central-bank-digital-currency-the-e-cny-idUSKBN27Q24X

- The United States' crypto policy in 2025 prohibits the creation of a Central Bank Digital Currency (CBDC) and instead establishes a strategic Bitcoin Reserve and Digital Asset Stockpile focusing on stablecoins from forfeited assets.

- Regulatory agencies like the SEC in the U.S. show a cautiously open stance towards crypto exchange-traded products (ETPs), signaling heightened scrutiny on investor protections, custody, asset valuation, and operational risk for crypto funds.

- In July 2025, the U.S. passed the GENIUS Act, the first federal legislation aiming to provide clarity and consumer protections for stablecoins, fostering integration of digital assets into the regulated financial system.

- China's digital yuan (e-CNY), a CBDC, is controlled by the People's Bank of China and uses blockchain technology primarily for domestic monetary control, anti-money laundering, and state surveillance during its widespread rollout as a CBDC accessible to consumers and businesses.

- The U.S. approach to cryptocurrency is different than China's, emphasizing privately-led innovation and promoting a regulated crypto ecosystem that integrates with traditional finance, while China's digital currency leverages blockchain for monetary reform and centralized control.