Rising tariffs lead to a projected decrease in global smartphone sales, according to IDC's prediction

The technology industry is facing a period of uncertainty, as a new report by IDC predicts that global smartphone sales will grow by just 0.6% overall in 2025, a significant drop from an earlier forecast of 2.3%. This downturn can be attributed to the ongoing US-China trade war and the potential impact of tariffs.

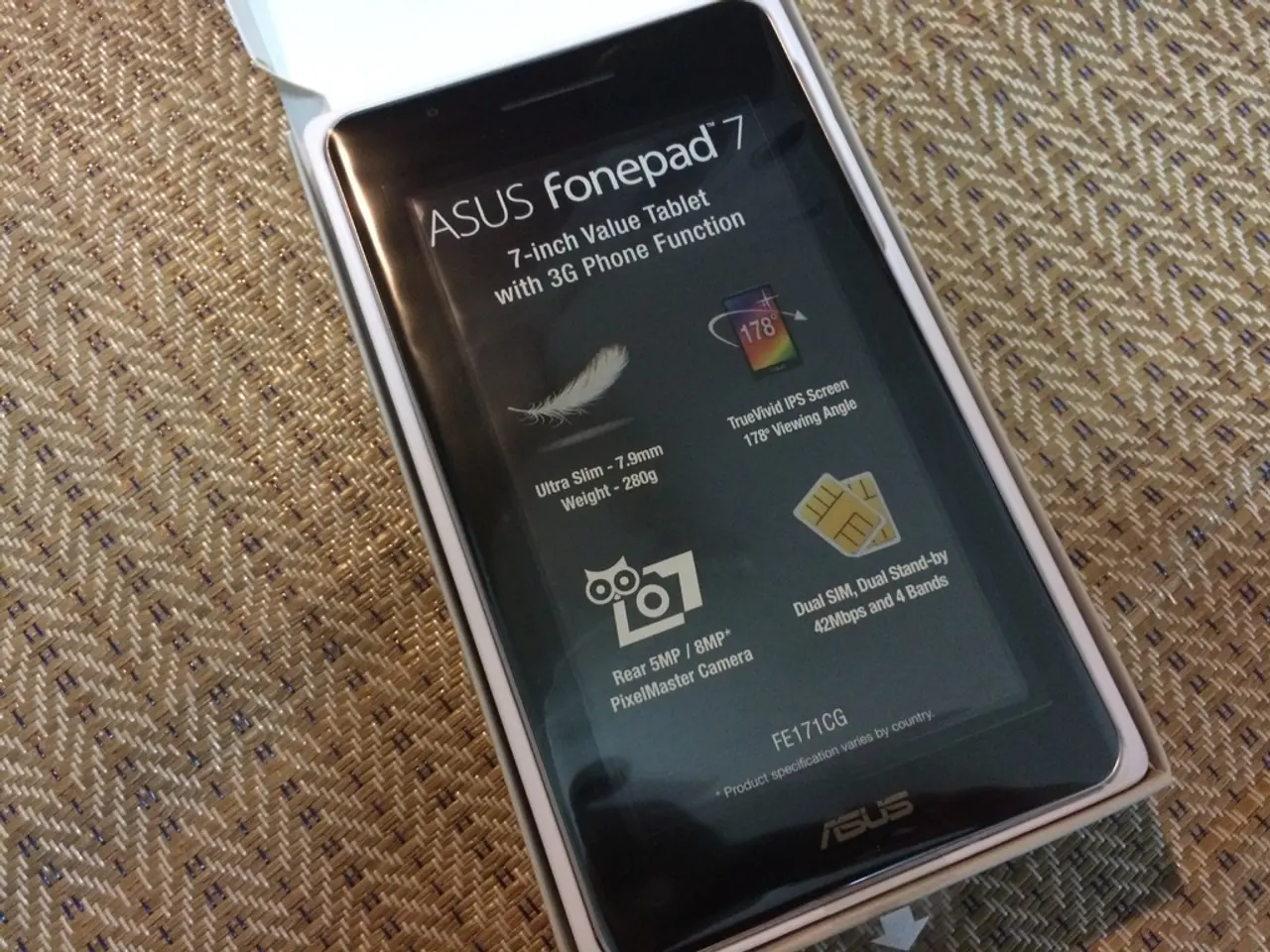

The report highlights that the US tariffs on China have contributed to a reduction in demand for PCs and tablets, and these tariffs are also affecting the broader electronics supply chain, which includes smartphones. The tariffs are part of a weakening market sentiment that generally negatively impacts demand in personal computing and connected devices sectors.

One of the ways manufacturers are mitigating tariff impacts is by increasing production in alternative locations, such as India. In fact, Apple has been leveraging production in India to offset some of the tariff-related challenges. India’s growing role as a global manufacturing hub, coupled with supportive policies like production-linked incentives, is helping the industry navigate these complexities.

The trade restrictions and export controls by the US on advanced semiconductor technology are also impacting supply chains for high-end AI chips and smartphone components sourced from China. This has led to innovation and adaptation in alternative production strategies globally, including in China aiming for self-sufficiency.

Despite these challenges, consumer demand for premium smartphones with advanced AI features remains strong, especially in regions like the US. Emerging markets are also growing for more affordable 4G/5G devices, suggesting regional market shifts rather than a global sales collapse.

Nabila Popal, senior research director at IDC's Worldwide Quarterly Mobile Phone Tracker, stated that the smartphone industry has faced a whirlwind of uncertainty due to the possibility of broader tariffs. The report suggests that smartphone sales will remain low for the next five years, averaging at 1.4%.

However, the future may be looking less uncertain for OEMs outside the US, following a recent ruling by the US Court of International Trade. The court has ruled to halt President Trump's 10% tariffs on "virtually every U.S. trade partner." This decision could potentially provide some relief to the industry and help stimulate growth.

In terms of regional growth, the US market is forecast to grow by 1.9% in 2025, down from an earlier forecast of 3.3%. China is predicted to be a major contributor to the growth in smartphone sales this year, despite increasing trade tensions. However, IDC predicts a 1.9% decline in Apple's sales in China, with Huawei taking the lead.

The report attributes the low sales to consumers retaining their phones for longer and a trend of buying refurbished smartphones. The uncertainty around fluctuating tariffs and economic challenges like inflation and unemployment are causing a slowdown in consumer spending.

Despite these challenges, the global smartphone market is currently experiencing a high level of uncertainty due to the potential impact of tariffs. India and Vietnam are expected to remain key alternatives to China for smartphone production, encouraging manufacturers to diversify production and innovate component sourcing outside China. The industry will continue to adapt and evolve in response to these challenges, ensuring the continued growth and development of the smartphone market.

Gadgets such as smartphones are affected by the ongoing tariffs and trade restrictions, causing a reduction in demand and affecting the broader electronics supply chain. Manufacturers are seeking alternatives to China for production, with India becoming a significant player due to supportive policies and cost-effective labor.

Despite the downturn in global smartphone sales for the next five years, IDC predicts that the market will adapt and continue to grow, with India and Vietnam serving as key alternatives for smartphone production. This shift in manufacturing locations will encourage manufacturers to innovate component sourcing outside China and ensure the continued development of the smartphone market.