Sui Blockchain Takes a Leap into U.S. ETF Market: 21Shares Files for Nasdaq Trading

Nasdaq, in conjunction with 21Shares, have submitted an application for the SUI ETF. Attention now turns to the SEC for review.

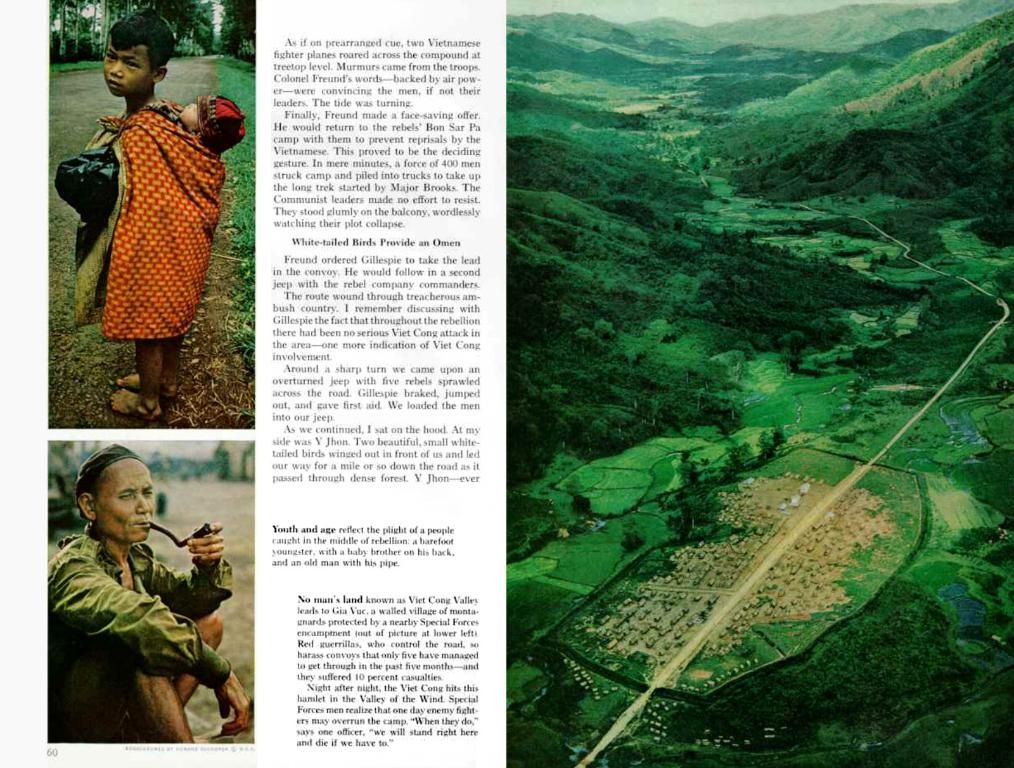

The 19b-4 filing, a continuation of S-1 registration statement submitted back in April, marks the launch of the SEC's review process. The filing is now publicly accessible on the SEC's website.

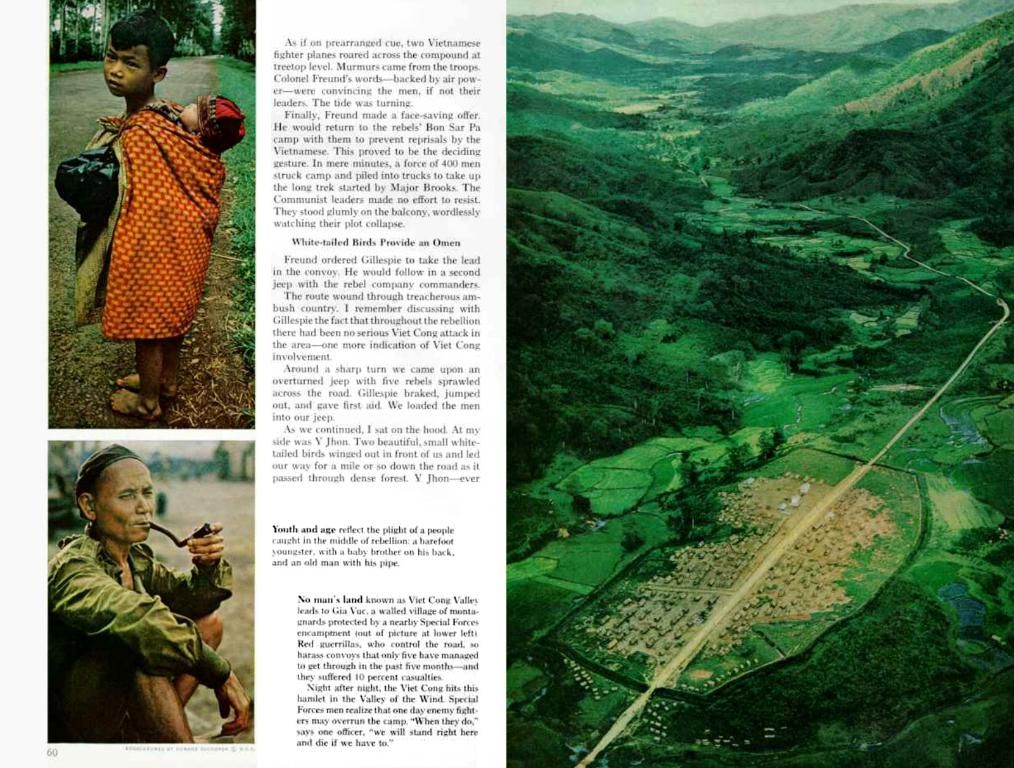

From Europe to the U.S., 21Shares Leads the Pack

21Shares' entry into the U.S. ETF market underscores the rising corporate intrigue in the cutting-edge Layer 1 blockchain, Sui. After already providing SUI-based investment products on Euronext Paris and Amsterdam exchanges in Europe, 21Shares has seen substantial investment inflows in recent months.

Bonus Read: Memecoin ETFs May Arrive by 2026, Application Process Begins

According to data from the Sui Foundation, a staggering $300 million has been invested worldwide in SUI-related investment vehicles. If approved for U.S. trading, the blockchain stands to reach an expanded audience. Financial titans such as Franklin Templeton, VanEck, Grayscale, Canary Capital, Ant Financial, and more have already dived into Sui-related projects since late 2024.

Kevin Boon, CEO of Mysten Labs, had this to say about the development:

"The Sui ecosystem has become a significant attraction for serious investors and developers. With 21Shares spotting rising trends ahead of time, the Nasdaq listing, just two years after launching our mainnet, is a significant milestone. We support this process as it brings SUI accessibility to every investor."

DeFi on an Upswing, SUI Under Pressure

Q1 2023 saw remarkable growth in Sui's decentralized finance (DeFi) ecosystem. The average daily volume of decentralized exchanges (DEXs) surpassed $304.3 million, marking a 14.6% increase from the previous quarter. Cetus and Bluefin led the trading, with platforms like Kriya, DeepBook, and Turbos contributing to the liquidity pool. However, SUI's market capitalization plummeted by 40.3% to $7.2 billion.

Although SUI peaked at $3.96 in mid-May, it slumped below $3.00 in early June due to the broad market downturn. As of June 11, it has bounced back to around $3.50.

Hurry! Claim Your Exclusive $600 Reward from Binance! Sign up here and secure your exclusive $600 Binance gift!

Enrichment Data:

Overarching:

Rising corporate interest in the Sui blockchain is a sign of increasing institutional involvement in emerging blockchain technologies. Key factors driving this interest include:

- Innovative Layer 1 Architecture: Sui's unique layer 1 blockchain architecture has piqued the interest of corporations, which view it as a promising platform for future growth and innovation.

- Growing Institutional Adoption: The potential U.S. listing of a SUI ETF could enhance Sui's market credibility and attract institutional investors, further solidifying its position in the market and encouraging further adoption.

- Potential for Mainstream Integration: Financial products such as ETFs could help integrate Sui into mainstream financial systems, increasing its reach and attractiveness to a broader audience.

ETFs and Regulation:

- The Regulatory Review Process: The 19b-4 filing serves as a request to list a spot SUI ETF and initiates a regulatory review by the SEC.

- Expanding Investment Opportunities: A spot ETF would make it easier for institutional and retail investors to invest in SUI without directly owning cryptocurrency.

- Market Impact: Approval of the ETF could significantly increase Sui's liquidity and credibility, attracting more institutional investors and boosting its presence in the crypto market.

Sui Ecosystem Developments:

- Secure Asset Management: Integrations such as Tangem wallet support secure management of Sui ecosystem tokens, enhancing user interaction with the blockchain.

- Ecosystem Tokens: Popular Sui ecosystem tokens, such as DEEP, CETUS, and FDUSD, are being closely watched for their market performance and on-chain activity.

In summary, escalating corporate interest in Sui blockchain is driven by its innovative layer 1 architecture, growing institutional adoption, and the potential for mainstream integration through financial products like ETFs.

- The escalating interest from financial titans, such as Franklin Templeton, VanEck, and Grayscale, in Sui-related projects indicates their belief in the technology's potential for future growth and innovation in crypt Finance.

- With 21Shares' entrance into the U.S. ETF market, technology like SUI stands to benefit from expanded audience reach, as investment vehicles backed by SUI continue to gain traction in Finance and are integrated into mainstream financial systems.