Financing Connectivity: Navigating the Transition from Traditional Finance to Decentralized Finance through Ondo

Here's a fresh take on the provided content, maintaining an informal and straightforward style while integrating relevant insights sparingly:

This is the Deal, Homie: Ondo Finance – The DeFi Platform Bridging Digital and Traditional Worlds

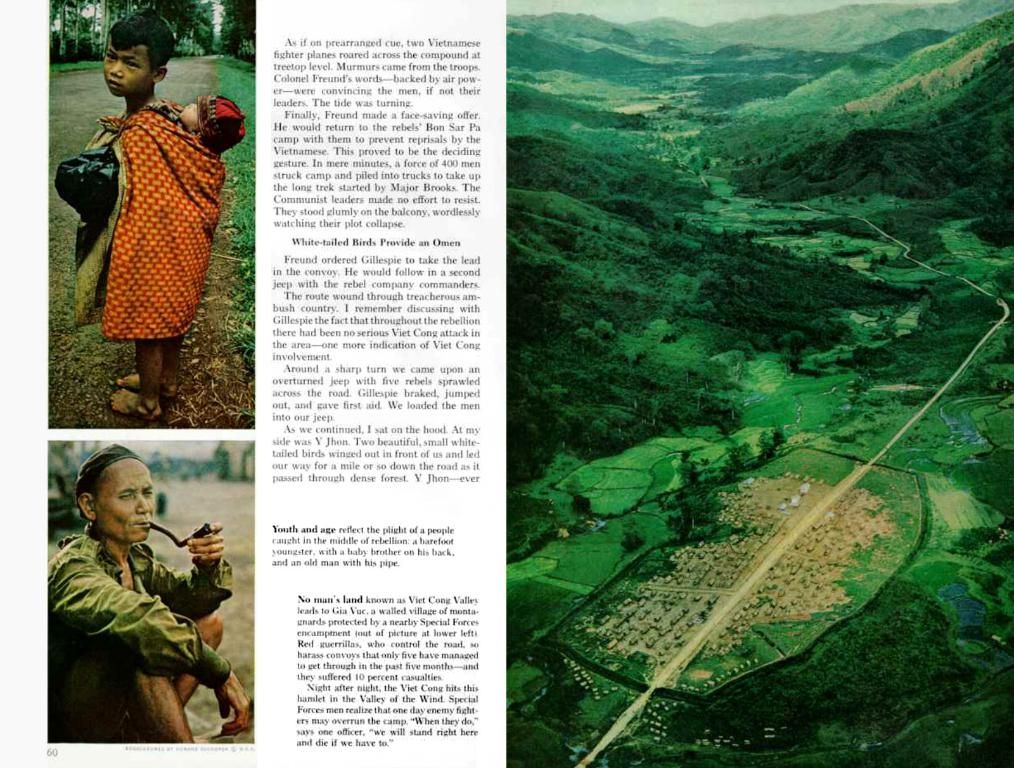

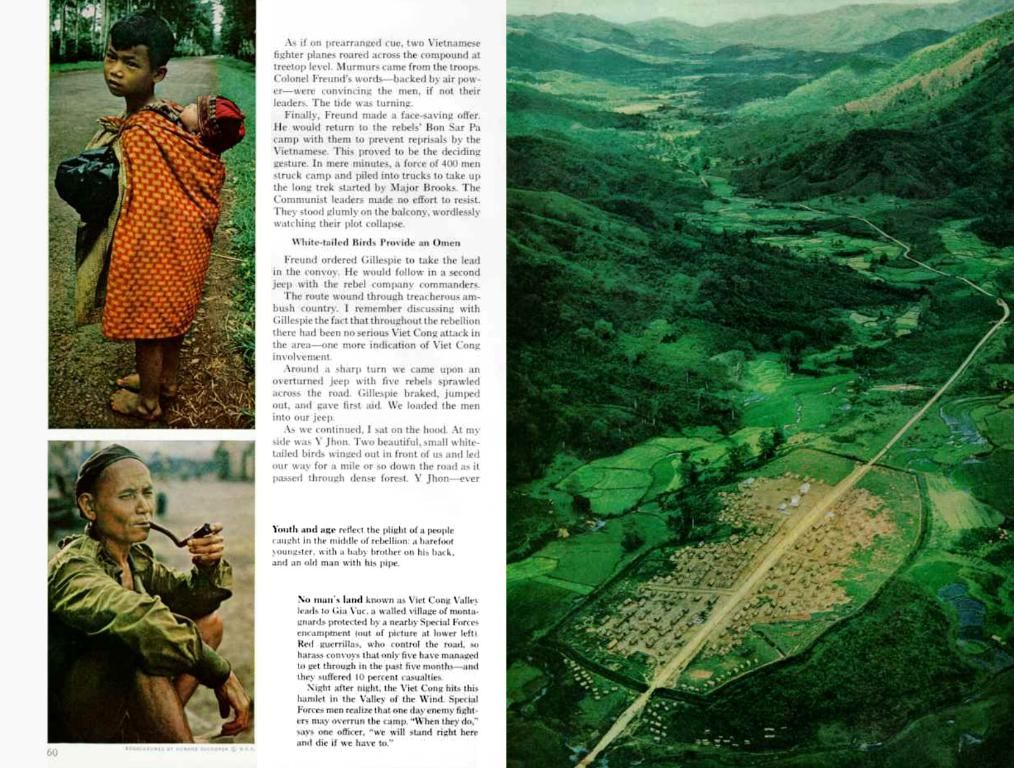

Listen up, folks! It's about time we dive into Ondo Finance – a DeFi (Decentralized Finance) platform that's making waves by connecting the dots between traditional finance and the crypto world. By tokenizing real-world assets, Ondo Finance is gunning for institutional-grade financial products to be accessible to the average Joe who's into crypto and wants to secure their financial future.

What's Ondo Finance, bro?

So, you're probably asking, "What in the hell is Ondo Finance, man?" In simple terms, Ondo Finance is an advanced decentralized finance platform that specializes in transforming traditional financial instruments like stocks, bonds, and even real estate into tradeable digital tokens on the blockchain. Why the hell would you want to do that? Well, it increases accessibility and liquidity, you know!

The Rise of DAFC (Digital Asset Financing Company)

Ondo Finance was kicked off by Nathan Allman, a former employee at Goldman Sachs, in March 2021. The platform took off like a rocket by facilitating the tokenization of real-world assets (RWAs) with a focus on bringing DeFi yields to a broader audience. Ondo Finance made headlines in 2021 when it launched its first product, Ondo Vaults, which attracted numerous investors with their unique approach that combined enhanced returns and downside protection. This success led to a cool $4 million raised during its first year.

In 2023, Ondo Finance kicked its offerings up a notch by rolling out tokenized U.S. Treasuries and launching the Ondo Money Market Fund (OMMF), positioning itself as a major player in the DeFi arena.

What Makes Ondo Finance Stand Out?

So, why should we give a damn about Ondo Finance, dude? Well, there are a few key features that set it apart from the competition:

Tokenization of Real-World Assets:By tokenizing RWAs, Ondo Finance makes financial instruments like stocks and bonds fungible, thereby boosting scalability and accessibility.

Permissionless Protocol:Ondo Finance operates on a permissionless protocol, which means users can join the party without needing any friggin' middlemen. This user-centric approach empowers individuals to control their financial future.

Predictable Yield:Tired of dealing with volatile asset prices? Ondo Finance got your back! It offers products that provide predictable returns, allowing investors to safely earn a steady income.

Integration with Decentralized Exchanges:Ondo Finance facilitates seamless liquidity provision and trading on decentralized exchanges (DEXs) like the ever-popular Uniswap, expanding investment opportunities.

Security Measures:Keeping your assets and personal info safe is crucial. Ondo Finance is famed for its robust encryption and security protocols to ensure your financial world is as secure as a horde of Fort Knoxes.

The Ondo Finance Suite – A Straight-up Arsenal of Tools

Ondo Finance is packing a punch with its suite of products, including:

USDY (U.S. Dollar Yield Token):Introducing USDY – a stablecoin alternative launched by Ondo Finance. Backed by short-term U.S. Treasuries and bank deposits, USDY offers users permissionless access and daily compounded interest.

OUSG (Ondo Short-Term US Government Treasuries):This tokenized asset provides exposure to short-term U.S. Treasury products, backed by BlackRock’s BUIDL – an offering designed for institutional investors.

Flux Finance:Flux Finance is a decentralized repo market protocol governed by the Ondo DAO, enabling lending and borrowing against tokenized securities.

Ondo Global Markets:Ready to take your investments to the next level? Ondo Global Markets aims to make a wide variety of public securities available on-chain, boosting their utility and accessibility within the DeFi ecosystem.

Ondo Bridge and Converter:Need a hand with cross-chain asset transfers or conversions between different yield-bearing token formats? Look no further! The Ondo Bridge and Converter have got your back.

ONDO Token – Taking the Reins

The ONDO token is the governance token of the Ondo Finance ecosystem. Catch the ONDO token trading at $0.97 with a market cap of $3.08 billion. This bad boy empowers token holders to participate in decision-making processes related to protocol upgrades, economic parameters, and overall management of the DAO (Decentralized Autonomous Organization). The total supply of ONDO tokens caps out at 10 billion, and the distribution is designed to align the interests of all stakeholders.

Ondo Chain – The Blockchain of Blockchains

In February 2025, Ondo Finance proudly announced the launch of Ondo Chain – a proof-of-stake (POS) Layer-1 blockchain specifically developed for real-world assets. The Ondo Chain aims to tackle challenges like liquidity fragmentation and transaction fee volatility, positioning itself as a prime solution for bridging traditional finance and the DeFi space.

Ondo Finance and the Crypto All-Stars – WLFI and BlackRock

Ondo Finance's popularity skyrocketed when it joined forces with some major players: World Liberty Finance (WLFI), backed by an ex-President, and financial heavyweight BlackRock. In February 2025, Ondo Finance partnered with WLFI to explore the integration of tokenized assets into WLFI's ecosystem. This move allows users to access treasury-backed assets, borrow, lend, and trade using institutional financial instruments.

Ondo Finance also teamed up with BlackRock's tokenized money market fund, BUIDL, in its OUSG product. This integration marks the ONDO token as a bridge between traditional finance and the DeFi world.

The Future Ahead – DeFi Meets Wall Street

With real-world assets being tokenized on the blockchain, the world of DeFi and traditional finance could be looking at some serious growth. In the near future, Ondo Finance plans to include corporate bonds, real estate, and global equity funds in its product portfolio. These additions could strengthen economic resilience and diversification in the DeFi ecosystem.

As we march forward, Ondo Finance aims to establish itself as a leading player in the financial services industry. If everything goes as planned, we might see it challenging established DeFi projects in the mid-cap tier. Time will tell, but for now, it's definitely worth keeping an eye on this promising venture!

Hey, don't forget to check out our latest article on Ondo Finance: Ondo Finance Unveils 'Ondo GM' Tokenization Platform. Keep slayin', folks! 💸🚀🔩

- Ondo Finance's tokenization of real-world assets using blockchain technology opens up the opportunity for institutions and individual investors to access decentralized finance (DeFi) products, such as Ondo Vaults, which combine enhanced returns and downside protection.

- The integration of Ondo Finance with decentralized exchanges like Uniswap not only provides liquidity for trading but also expands investment opportunities within the DeFi landscape.

- As Ondo Finance continues to evolve, it will potentially integrate corporate bonds, real estate, and global equity funds into its product portfolio, bridging the gap between traditional finance and DeFi, offering a promising future in the financial services industry.