SUI's Imminent Plunge and Potential Rebound!

Examining Factorspotential Reasons for a Potential Drop in SUI's Value to Approximately $3

Hey there! Let's dive into the recent happenings with SUI, shall we?

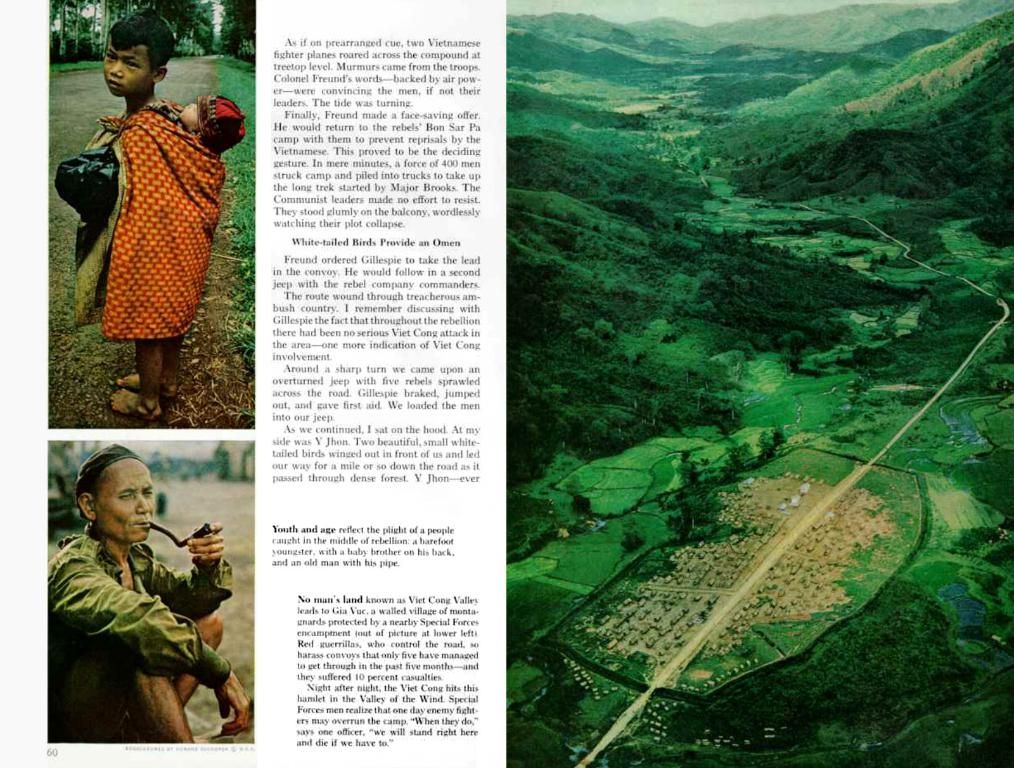

After a rockin' April, SUI took a nose-dive, shedding 8.8% since May 2nd. Despite maintaining a bullish market structure, it seems like our ol' friend SUI is about to take a short-term breather.

Just a teeny bit ago, Bitcoin skyrocketed from $85k to $93k, and SUI followed suit. However, BTC's recent rejection at $97k sent SUI tumbling down the rabbit hole.

SUI on a DroP to $3! But, Is a Buying Opportunity Near? 🤔

Source: SUI/USDT on TradingView

After erasin' almost the entire November rally by April, SUI's bulls have been fightin' tooth and nail to regain control. The market structure break was a bullish as hell sign, even though the $3.5-level wasn't held as a support.

Durin' SUI's rally of the past ten days, the CMF managed to poke its head above +0.05, showin' some substantial capital flow into the market. The MFI refl ected some bullish momentum, and didn't form a bearish divergence yet on the 1-day timeframe.

Together, the indicators and the price action werePointin' to some bullish vibes on the 1-day timeframe. A dip to $3.06, $2.75, and $2.45 may be imminent in the coming days, especially wit' Bitcoin's recent bearish momentum. In the end, the liquidation heatmap offered more clues 'bout the next SUI move.

Source: Coinglass

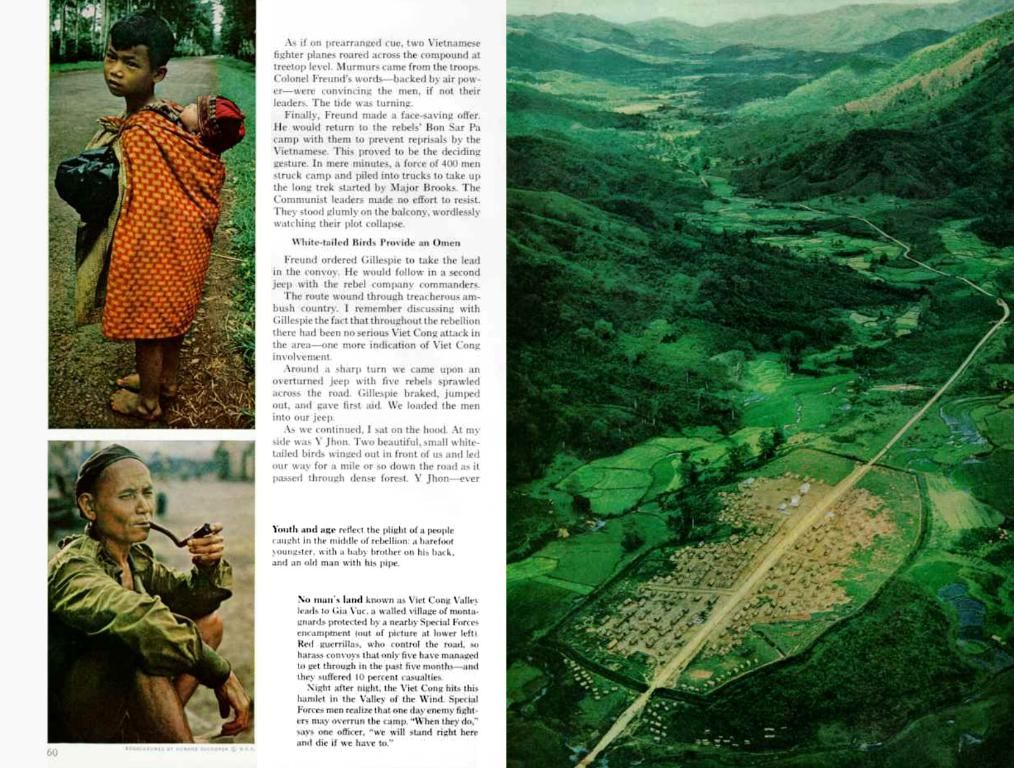

The 3-month liquidation heatmap unveiled that the $3.14 and $3 levels were the immediate liquidity pockets that the price would gravitate towards. Below that, the $2.8-level and the $2.3-level seemed to be magnets. However, these levels might not attract the price strongly.

So, it's highly probable that we'll see a dip to $3 in the coming days. It could offer a buyin' opportunity, but savvy traders might want to watch the sentiment around BTC before hoppin' in.

In case of a bullish reversal, the $3.9-level would be a liquidation cluster that the bulls might target next.

Caveat Emptor!

The information provided 'ere does not constitute financial, investment, trading, or other such advice. It's just ol' me spittin' my opinion, so do your own research, mate!

Enrichment Insights:

Expected Price Movement

- Short-term Prediction: By May 9, 2025, SUI might reach $4.17, representin' a 30.35% increase from its current price[4].

- Bullish Outlook: Some analysts believe SUI could rally even further durin' the summer, potentially reachin' levels as high as $11.5 after breakin' certain resistance levels[2].

Potential Support Levels

- Key Support Levels: $3.26, $3.18, and $3.08 are considered pivotal support levels. The trend remains bullish as long as SUI stays above $3.00–$3.20[4][5].

Resistance Levels

- Key Resistance Levels: $3.44, $3.54, and $3.63 are significant resistance points. A daily close above $3.80 could signal a further bullish move[4][5].

- The current decline in SUI's price has seen a drop of 8.8% since May 2nd, despite a bullish market structure.

- Bitcoin's recent rejection at $97k has caused SUI to take a tumble, following Bitcoin's price movement.

- In the coming days, a dip to SUI's potential support levels at $3.06, $2.75, and $2.45 might occur, due to Bitcoin's current bearish momentum.

- The 3-month liquidation heatmap suggests that SUI's price might gravitate towards the $3.14 and $3 levels as immediate liquidity pockets.

- A buy-in opportunity may present itself if SUI reaches the anticipated dip to $3, but potential investors should watch the sentiment around Bitcoin before jumping in.

- If there is a bullish reversal, the $3.9 level, with its liquidation cluster, might be the next target for bulls.

- The expected price movement by May 9, 2025, shows SUI reaching $4.17, representing a 30.35% increase from its current price, while some analysts believe SUI could rally further during the summer, potentially reaching levels as high as $11.5.