Euro currency reaches its peak in nearly nine months - prolonging its ascension

The Euro is still going strong, surpassing its highest point since early 2022 this week with a peak at 1.09 dollars on Monday morning. People are bullish about the Euro thanks to the expectation that the European Central Bank (ECB) will hike interest rates more aggressively than the Federal Reserve (Fed) this year.

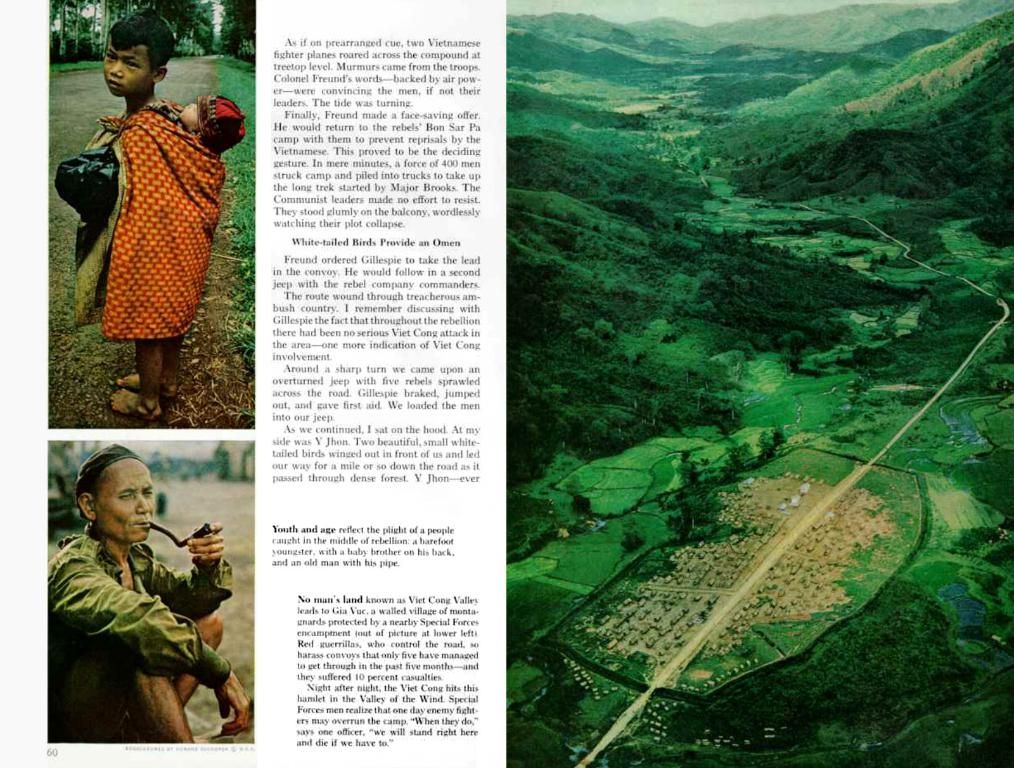

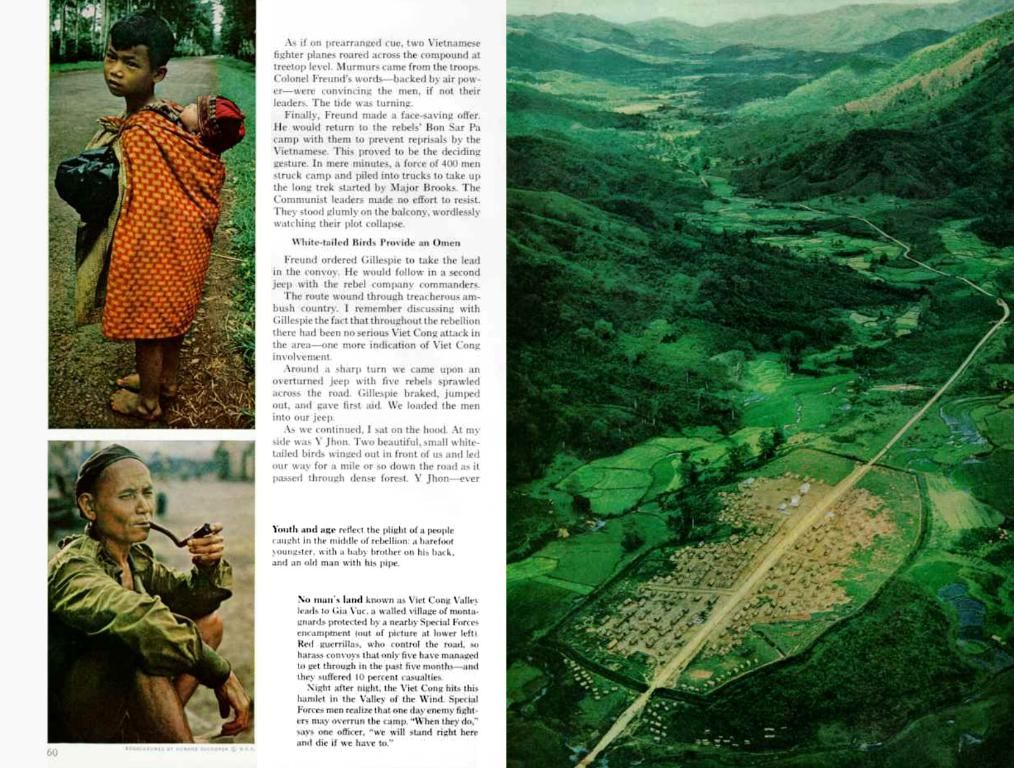

While concerns about Europe's economic downturn due to the Russian attack on Ukraine had pushed the Euro's value down to 0.9536 dollars in September last year, recent forecasts have gotten more hopeful. Thomas Altmann, portfolio manager at QC Partners, points out that the Euro's rising interest rates are making investments in the Eurozone more attractive for international investors.

During a panel discussion at the World Economic Forum in Davos, ECB President Christine Lagarde confirmed her intention to continue tightening monetary policy to combat high inflation. "Keepin' on course is my monetary policy mantra," she said. Other ECB representatives, like Klaas Knot, have also echoed this sentiment. Knot, the Dutch central bank chief, stated that the ECB should increase interest rates by half a percentage point at the next two meetings and could continue with rate hikes until the summer.

However, it's worth noting that the ECB is currently in a rate-cutting cycle, with markets pricing in further reductions through 2025. The ECB is expected to see three additional cuts by the end of 2025, reaching a terminal rate between 1.50% and 1.75%. The Eurozone GDP growth is estimated at 0.9% for 2025, driven by weak exports and investment amid trade tensions.

Despite these forecasts, the Euro's upward trend seen since autumn remains intact, with the "Golden Cross" at the end of December giving another buy signal. As long as the Euro stays above around 1.07 dollars, the rally could continue, with targets of 1.12 and 1.13 dollars in sight based on technical analysis.

Here's a fun fact: Some stocks are currently undervalued and might be worth buying. Analyze the market carefully before making investment decisions.

- The rising Euro has somewhat influenced the finance sector, making technology stocks somewhat undervalued for international investors, thanks to the tightened monetary policy by the European Central Bank (ECB).

- Despite the ECB's prediction of further rate cuts through 2025, the Euro's hike on Monday morning, reaching 1.09 dollars, suggests a possible continuation of the upward trend, with targets of 1.12 and 1.13 dollars.

- Investors may find some opportunity in the Eurozone's undervalued technology stocks, given the increasing Euro value, which is in part due to the ECB's commitment to hike interest rates more aggressively than the Federal Reserve in 2023.

- In light of the ECB's interest rate hikes and the Euro's ongoing surge, it's crucial to meticulously analyze the financial market before deciding on investments, as the Eurozone's economic growth and GDP are still projected to be relatively slow due to weak exports and investment amid trade tensions.